5 Key Strategies to Manage Business Money Better

Managing your finances should feature as a crucial component of any business plan.

That said, a lot of businesses struggle when learning how to manage business money better – when you have it and when it’s lacking, as well as how to manage it effectively overall.

The following are 5 key strategies you can use to better manage your money, and what you could be doing to manage it better.

1. Optimizing Your Free Cash

When you have free cash, which is money that doesn’t need to be ascribed to the cost of running your business, you should have it work for you.

First, it helps to set aside funds for an emergency situation – but from there, a surplus should be put to work to aid your business.

This kind of free cash can also be used for:

- Expanding your business

- Paying off debts in advance

- Maintaining a level of your working capital

It could also take the form of term deposits, investments, or purchasing assets for your company to help it run better – whether that’s in your workforce, or other ways to optimize your products of performance.

Overall, starting an “opportunity fund” of free cash is an ideal way that you don’t miss out on opportunities to grow your business – whether with deals in the moment or by investing in your company/workforce to improve your product.

2. Managing Cash Flow

It takes more than simply maintaining it to manage your money effectively.

In fact, you often need to think ahead with strategies to help boost your cash flow – and to guard against times when business might be slow.

A great way to learn how to manage your business’ money better is to start utilizing cash flow projections. This is a helpful way to see when you have money coming in, going out, and what cycles occur in your business.

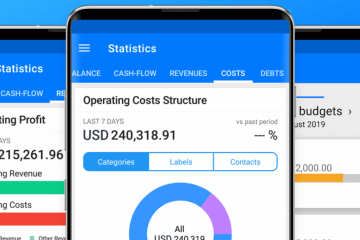

If you have many bank accounts, in multiple currencies, managing your cash flow is also going to get tricky. One of the best things is employing software to help keep track of where your money is coming in, going out, and ensuring you never miss a payment.

Once you synchronize your cash flow, you can begin to uncover even more insights into how your money is working, where it’s going, and what could be better.

There’s also the opportunity to provide discounts on your products/services, introduce new ones, or secure a line of credit should business slow down. There are multiple ways to boost your cash flow when you need it, but having it (and knowing more about it) is key.

3. Giving Proper Authorization

There’s little doubt that your money is important to your business.

That said, who has access to your money is just as important to keep in mind. Many businesses struggle with managing money because so many have access to it.

This is what is often referred to as “spend culture,” a set of shared beliefs among teams that inform how a team spends money – and what they spend it on.

It’s important that your business’ spend culture is more responsible and, therefore, more effective toward your outcomes. Ultimately, it provides more value when you spend.

You need to ensure that only authorized people have access to money concerning your business. This includes:

- Signing contracts

- Initiating payments

- Accessing cash

If you feel like your business currently isn’t handling its money well, you should consider reconsidering and restructuring those who have access to it.

Business credit cards are also essential. They can be a useful tool to help with gaps in cash flow, but they need to be considered discretionary funds allowed to only certain team members who can be trusted within a business.

Once you have proper authorization over who can spend your money, or implement ways to consistently review that authorization, then your money will be managed better.

4. Utilize A Cash Flow Budget

We can’t emphasize enough just how important a cash flow budget can become.

It allows you to ensure that you can comfortably pay off expenses while enabling you to manage your revenue and expenses without worry.

Even more important is that this is kept up to date, managed on twelve-month cycles, and used in an operating fashion to help the success of your day-to-day operations.

The more insights you can gain on your finances, the better! A budget is a fantastic place to start charting that and setting the direction for your company and how it spends its money.

5. Recognize Sensitivities in Cash Flow

A great way to manage your money is to keep a close eye on it.

While we don’t mean that literally, we do think it is important to recognize and analyze the sensitivities which exist in your cash flow.

This might include pinning down items, like price, volume, or overheads, which will have the most impact on your cash flow.

Some of these things, like your cost of goods sold, may be difficult to change. That said, it can help your business better manage risk to understand where large swings can have a large effect on the way you work.

Manage Money Effectively with Board

Board is a tool you can use to manage your money by gathering insight, keeping a close eye on cash projections, and building a budget that works for you. Want to learn more about how it works? Click this link for helpful resources, or learn more by trying it for yourself.

Find it on the App Store or Google play or try our WebApp.