How Much Cash Flow Should My Business Have?

It’s a question we hear a lot from small business owners: how much cash flow should my business have?

While it might vary from business to business, what doesn’t change is just how essential cash flow is going to be to your success. If you don’t have positive cash flow, that’s a red flag that you’re going to need to address.

In this article, though, we will:

- Discuss the importance of cash flow

- Determine how much your business needs

- Provide you with tools to make better business decisions

Cash Flow: The Whole Story

One of the great challenges for any small business is going to be managing cash flow. Basically, your cash flow can be recognized as:

- Money Received – Sum total of operating revenue (selling goods and services) as well as new funding (equity investments, etc.).

- Money Spent – These include your operating costs (like space, payroll, and more) as well as repayments and acquisitions.

If you are struggling with this already, your business is in trouble. That’s because positive cash flow is how businesses pay rent, employees, and keep the lights on.

That’s why, first and foremost, you should always have a great idea of your business’ cash flow – how much is coming in, going out, and when it is doing each.

Properly managing cash flow can be based on four key skills:

- Planning

- Forecasting

- Tracking

- Acting on Variance

We’ll break each of these down into greater detail, but for now it’s important to know that you need to set goals, envision the future, manage the day-to-day, and make decisions based on conditions in the marketplace.

Got it? Now, let’s talk about how much cash flow your business should have.

Cash Flow: How Much Do I Need?

So, the simple answer here is: as much as possible!

That said, depending on your business, that may not be possible. Cash is imperative to the growth and operation of your business. It allows you to do so much, and it also affords you the opportunity to drive growth into the future.

The typical rule is that you should maintain cash equal to 3 – 6 months of your operating expenses. While it might differ from business to business, this will ensure that you have the money to pay employees and maintain operations even in a down market.

That said, how much cash flow you need is likely going to be based on the following. Ask yourself:

- How much cash have I been using in the past?

- What stage of growth is my business in right now?

- How much cash do I plan on using?

- Is it going to take long to make more cash?

All of these questions, and their answers, may change your decision making. Basically, if you are a small business and you are looking to grow, you need to build into your cash flow a way to ensure the growth of your business well into the future.

So, how do you do that? Let’s talk about one of the essential elements of a proper cash flow strategy: the cash flow buffer.

Building A Cash Flow Buffer

In terms of cash flow, a cash buffer may truly help your business succeed – even during difficult times for your business.

Also known as “cash on hand” or a cash reserve, this is an amount of money set aside for no immediate use or spending plan. Think of it like a safety net for your business.

Cash is always going to be an issue for business of all kinds, so a buffer can ensure that you are able to navigate slow periods with ease.

Making Decisions Based on Data

This all comes back to the four essential skills we mentioned earlier: planning, forecasting, tracking, and acting on variance.

How much cash flow do you really need? That’s going to come down to how well you’re projecting the health of your business.

Cash flow projects are an expectation of what will happen, with respect to your cash flow, in the coming months – based on past performance.

If you keep a close eye on your finances, projections can reveal themselves to the ideal way of determining just how much cash flow your business is going to need.

And, as critical as a budget, these projects can offer real insight and strategy into how you should be running your business well into the future.

A cash flow projection can help with the following:

- Identifying slow periods for your business

- Taking advantage of growth and excesses of cash

- Ensuring you have enough to pay suppliers/employees

Most businesses know that they need cash flow projections in order to identify problems and to stay successful, but they don’t know where to start. That’s where Board comes in.

Board: The Small Business Solution

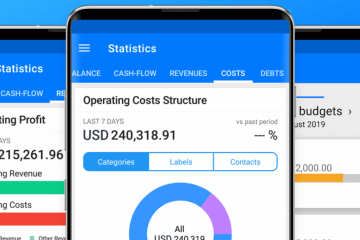

We developed board as a mobile business management platform to help small business owners gain full insight into their cash flow.

By learning about budgeting, day-to-day financials, and projections/reports that provide actionable insight based on hard data, we make your life easier.

It’s an application designed around you and your business. Developed to help you grow, manage risk, and understand your goals for the future.

A huge part of that is recognizing your cash flow, how much you need, and how much you will need moving into the future. It can help you manage growth, game-plan for success, and gain access to data you never thought possible.

Start by signing up for our WebApp today. Or, find the app on the App Store or Google Play.