Building the Perfect Small Business Budget with Board

What’s your small business budget?

So you’ve got a small business up and running, or maybe you’re thinking about starting one. You know already that half of all small businesses shut down in less than 5 years. Among the top reasons are insufficient financing, and a lack of effective budget management.

How can you use Board’s flexible budgeting system to understand how that business is going to operate in the future?

Why use Board instead of a classic budgeting system or a spreadsheet? We’re glad you asked. This post is going to talk about Board’s budgeting process, and how it’s set up to adapt to your particular business needs.

Reality Based Budgeting

Usually when we think of building a small business budget, we think of it in terms of accounting. The process that defines most budgeting tools is making predictions about the future, and hoping that you’re right. You often won’t know how realistic your budget is for several months at least. And worst of all, you may find out too late that you’re spending way too much.

How much is electricity going to cost? Take a wild guess? How much will you have to pay for basic supplies? Again, it can be pretty hard to say.

Board by BudgetBakers is a little different. We choose to focus on the reality behind your actual spending in order to build reasonable budgets for the future.

How do we do this? Simple: we start with transaction data and your real live business, and we build projections, which you can then turn into budgets. That turns a prediction about the future into an aspirational goal. Are your costs projected to be too high? Fine, just create a weekly budget to reduce them.

The added benefit of reality based budgeting is that it does not have to be done in advance of starting your business. You can start any time, and in fact by waiting until your business has been operating for a few months to set realistic budgets, you will be able to gather real-world data about how much certain things are really going to cost.

A major blocker for small business owners getting started with proper budgeting is that there is so much information to analyze. It can often feel frustrating and futile to predict the future, particularly if the past is so complex that we can’t easily understand how our cash flow works.

Budget like a pro: How to Build Your Small Business Budget

This is all why BudgetBakers products focus on recording and categorizing transactions before focusing on planning.

By first importing and clearly labelling each of your transactions over a period of time reaching into the recent past, you are also teaching Board how to find and label future transactions that affect your budgets and goals.

So the first step in creating a reality based budget is to categorize as many of your past transactions as you are able.

The next step is a natural progression: after adding past transactions and labelling them, you can begin to enter expected future transactions, also under their appropriate labels.

Once this process has been done, the good news is that it will become automatic. New expenses will be compared to planned expenses, and your budget will be automatically updated to compare with your real financial performance.

Setting Core Budgets

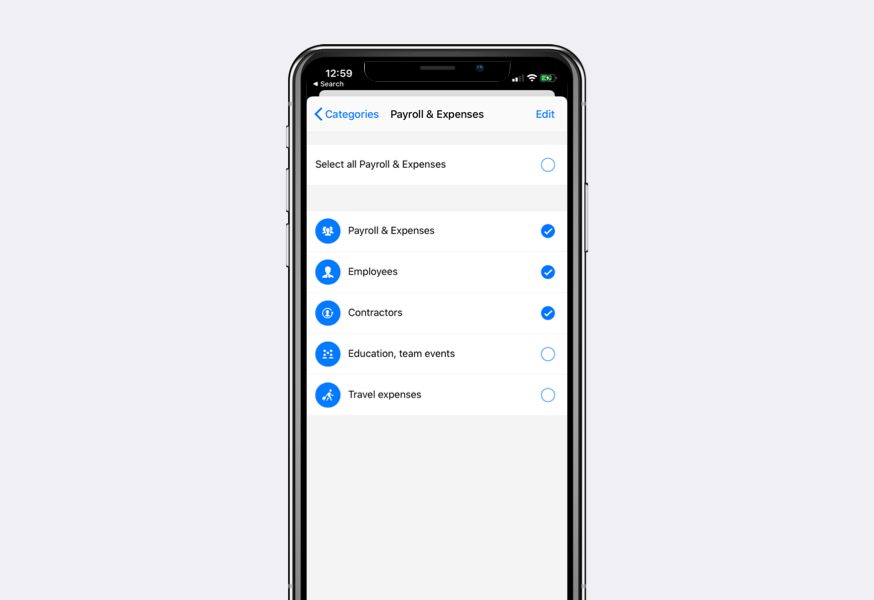

Once your transactions are fully labelled, you can begin to define your core budgets. In Board, we don’t take a whole-company approach to your monthly budgeting. Instead you are able to define specific areas of the business that need to be budgeted for.

For example, you may choose to set budgets for things like: Utilities, HR Costs (salaries), Rent and Leasing of Equipment, Insurance, or any number of other potential costs. By setting the transaction labels that will be swept up in each budget, you save yourself all the future work of locating and including future transactions in those categories.

This means that in the future, incoming expenses will automatically be deducted from your budgets, and you’ll be able to see (and perhaps recategorize) each individual transaction that affects each area of your business.

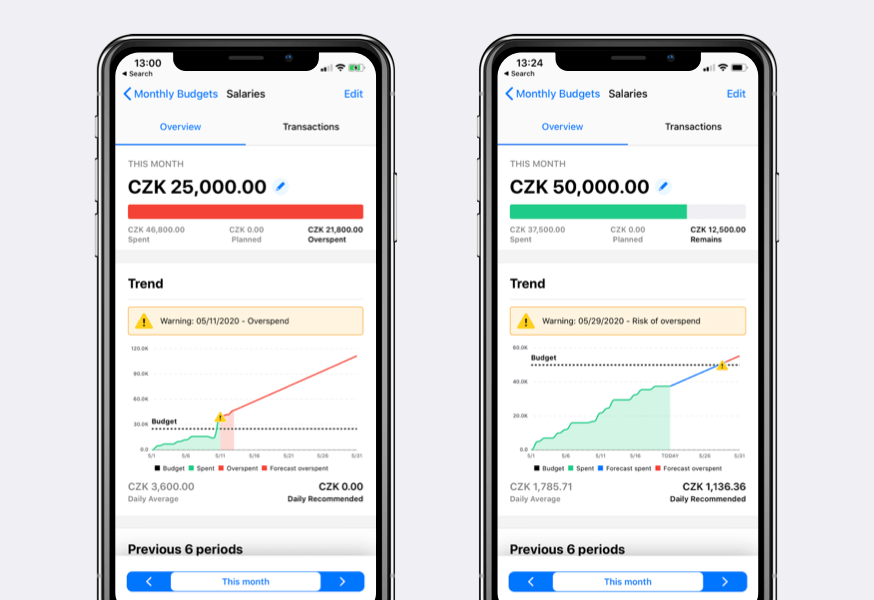

Overspend Risk

A big advantage of our flexible budgeting system is that you can see dynamic warnings of your overspending risks, with an exact date when you are predicted to go over budget, based on past data.

Reality Checking Budgets

Since you will already have a set of transaction data against which you can compare your projections, you will be able to easily see whether your ideas about your budgeting are realistic or not.

You’ll also be able to quickly see which expenses are being mis-categorized, and correct them, getting you the exact transactions that should be affecting each of your budget categories.

Finally, once you’ve set all your past expenses and transactions into your budget, you can check to see if it makes sense. Are you able to eliminate some of these expenses, now that you see them all in one place? Or do you need to budget more for this category? Now you have the data that will help you decide.

Setting a Secondary Budget

Once your core budgets are set, you can enhance your control of expenses by setting secondary budget categories. These are the categories where you may have more flexibility in terms of costs and outlays. Examples might include your marketing budget, new inventory, or repayment of loans.

Having these flexible secondary budgets helps you set aspirational goals, and put the money you’re saving in your core categories to work on new activities to help grow your business.

Adjusting Cash Flow Goals

By setting up primary and secondary budgets, you will be in a much better position to begin setting cash flow goals.

Small business lives and breaths on cash flow. You need more money coming in than goes out, or pretty soon you’ll be out of cash. That’s why setting budgets that dynamically affect your cash flow projection can help you understand things like: how quickly to repay a loan, how much you can safely pay yourself from company money, or how much you are able to spend on new materials, improvements, or stock for your business.

Budget: Take Control of the Big Picture

Budgeting is a source of anxiety for many small business owners. But it doesn’t have to be an anxious activity for you. We hope you’ll find that within a few weeks of setting up comprehensive budgeting and cash flow goals in Board, you’ll be much more equipped to look at your daily cash flow and smile, with the confidence of someone who knows where their money is going.

Learn more about Board at Board.BudgetBakers.com, or find it on your app store: