Which Business Debt Do You Pay Off First?

Nobody likes to talk about it, but debt is a way of life.

In fact, when running a business debt is essential to getting off the ground and to keep your business running.

That in mind, it’s important to know the levels of debt, and which debts you should consider paying off first (whenever you might come into some free cash).

Your Exposure to Debt

The first thing to ask yourself, and to asses, is how your debt is spread about.

It might be something as simple as carrying a balance on a credit card, or a line of credit, but it helps to start by building a budget of your debt (and your payments).

This way, when you come into free cash, you can better move that money around to facilitate payments and avoid the risk of late fees. The easiest way to know which business debt to pay off first is the one with the highest interest rate.

A well-thought-out budget, along with mindful cash flow projections, can help you crunch the numbers to understand when money is coming in, when it might be less than normal, and how that extra income (or lack thereof) can go toward your debt.

Good and Bad Debt

If you start with a budget, an effective rundown of all the debt you have, it helps to understand the kind of debt that is good for your business – and the kind that is bad.

While this isn’t always the case, it is a perspective that can help frame our conversation around business debt (and how to approach debt with different levels of urgency).

That said, there are some examples of “good debt” to take on:

- A loan to buy new equipment

- A loan to hire more employees

- A loan to invest in property

Essentially, if your debt can clearly take you to the point of generating more revenue, then it is a good debt to have – it is actively feeding your business and helping you become more successful.

Bad debt is the very opposite, and sometimes it can cut the same way. You can invest in the wrong product, ineffective workers, or property that loses value over time.

So, the risks of debt always exist. Instead, it helps to build a plan to mitigate the risks associated with debt and to pay off debts whenever possible.

Prioritizing Your Debt

The key here is to understand business debt, how it works, and how you should be prioritizing your debt to feed the future of your business.

Here are some common examples:

1. Bank Debt or Vendor Debt

One of the main questions that people ask when it comes to paying off their business debt is whether they should pay off the bank or the vendors’ invoices (which may be overdue).

In most cases, your vendors may be the lifeblood of your business. If you have free cash, and are past due, paying off those invoices (while making minimum payments to your bank debt) would be essential.

Instead of thinking one or the other, it is instead about prioritizing the fulfillment of one debt over the other. Chances are your bank debt is better able to handle minimum payments, rather than a vendor who’s relationship you rely on when they require their money.

2. Which Vendors Get Paid First?

This question is going to vary by business and by industry. It requires you to do a deep dive into your vendors, and really consider the ones who make an impact on your business.

Ultimately, you need to focus on vendors who contribute to the day-to-day success of your business. They are not relationships that you want to lose and should be treated as such.

3. What About Employee Debt?

If your employees don’t get paid, then they simply will not work.

That said, many businesses go into debt to help satisfy the salary requirements of their employees. Charging it to a line of credit or in other ways.

If your free cash cannot help pay back this debt, and it continues this way for years on end, it may be time to reassess the employees you have – instead of asking how you are going to pay their associated debt, it might be worthwhile analyzing how much they bring in.

It is not an easy decision, but if employees are causing your business to go into debt, you need to be sure that they are the right employees to help bring you out of debt.

4. What About Factoring?

Factoring, otherwise known as invoice or accounts receivable factoring, is allowing a third-party to collect a debt from an invoice on your behalf. In exchange, you receive a quick injection of cash – which you may use to pay off other debts.

It is true, though, that factoring comes with its own set of risks. It can protect you against bad debts and improve your cash flow, but it may also result in higher interest and can influence the standing of your business.

In any event, factoring is not something that should be taken lately and should be done in conjunction with cash flow projections and a deep understanding of your finances.

The Role of Business Debt

It’s true: debt is a vital element of any business’ journey.

However, understanding how debt works, what constitutes a good and bad debt, and which debt you should pay off first is just as vital.

All of this goes back to your goals as a business owner, and how you want to go about growing your business in a meaningful way.

Whether you simply want to start with the debt with the highest interest or the one that helps your relationships with vendors, it is helpful to begin with the smallest debt – because the removal of debt entirely can be the most satisfying of all.

Debt, Your Finances, and Board

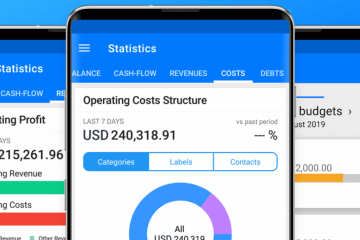

Interested in learning more about your debt impacts your long-term cash flow projections?

Board is the tool that you need. Learn more today about how your business can improve with Board’s help, or start your free trial today.

Find it on the App Store or Google play or try our WebApp.