The Best Revenue Forecasting Methods for Your Business

When it comes to revenue forecasting, it’s all about your business.

Not only the future of your business, but exactly where you work, you industry you work in, and what you end up providing consumers/clients.

In order to prepare an accurate budget, which is like the yearlong strategy for your business, you need to develop revenue forecasts to assess the state of your business moving forward.

What is a Revenue Forecast?

Essentially, a revenue forecast is an educated prediction or estimation for the upcoming year about how much money your company is likely to bring in.

This allows you to determine how much you can spend, and what your margins will be overall.

Once you have a better idea of the total amount of money coming in and out of your business, you can build a more relevant budget to your long-term goals.

If you are at a point during the year where you might get off your track, your forecasts can serve as a useful reminder of where you should be – better affording you the ability to understand deviations from the track you have set.

Forecasting is also an essential tool to help plan for your growth in your business. Whether with new hires, launching campaigns, or cutting costs when business slows down. You can better see how your money needs to align in timing with your initiatives.

How Do You Begin Revenue Forecasting?

There are numerous methods to revenue forecast effectively, so let’s break it down.

Revenue forecasting is equal parts art and science – you need to rely both on judging the market and past performance.

In fact, if you have have been in business for years, the best place to start is with your previous year’s revenue forecasts as a foundation to predict what will occur in the coming year.

From there, you can begin to think of any changes in:

- Personnel

- Products offered

- Industry Competition

But, let’s dive a bit deeper to consider the other ways you can go about revenue forecasting.

Revenue Forecasting: Bottom-Up Planning

This is one way to think of revenue forecasting in terms of your business.

Begin with your existing customers, the contracts you currently have running, opportunities in the pipeline, and put them all together to understand where your current money is coming in.

What happens if you are disappointed with your forecast? The next best thing is to put together a plan to acquire new customers and estimate their value in time. This can help determine if acquiring them is worth it, and if it features in your long-term success.

Revenue Forecasting: Top-Down Planning

On the flip side, you can also build a revenue forecast with a top-down approach.

Start by researching the size of the addressable market for your product or service. Analyze your competition, their market share, and set how much of that market you would like to capitalize on with your business.

Next, estimate your organic sales. Between that share and your goals, take into the account the cost of sales (how much they cost to acquire) versus the revenue (the value of the sale over the course of its lifetime) to close that gap.

Finally, calculate the resulting marketing and sales cost. Compare it with your budget, and adjust your plan accordingly.

Should You Update Your Revenue Forecast?

It’s simply a fact: nobody can forecast revenue with 100% accuracy. That’s not the point.

The idea is to lay down important assumptions that can be regularly monitored and compared to the performance of your business overall.

A forecast is a living document, meaning that it changes with the times. Ideally, you would keep your revenue forecasts up to date once per month, or every quarter, to ensure that they are consistently in line with your goals.

Revenue Forecasting Methods You Can Use

The following are revenue forecasting methods you should consider to make forecasts more in line with your goals and plans for the future:

1. Start with Expenses (Not Revenues)

This applies to business in the start-up stage. An ideal place to start with forecasting is to focus on your fixed costs and overhead, things like rent, utilities, technology, and salaries.

Consider doubling or tripling your estimates, in the event that you need to invest more in things such as marketing, legal, or licensing fees.

Even if you’re doing these activities yourself, keep track of sales and customer service time as an expense of labour. When you have more clients, and more workers, knowing this kind of expense will be essential.

2. Forecast Conservatively and Aggressively

If you are a business owner, you need to toe the line between conservative estimates and your aspirations for your business.

Instead of creating forecasts based on conservative guesses, it might be helpful to create two sets of forecasts: one that is more in line with current realities, and one that is catered more to an aggressive growth strategy for your business.

In creating these types of forecasts, you may even begin to strategize new thinking and ideas to succeed even more with your business.

3. Check Key Ratios

There are a handful of ratios which can help guide your revenue forecasting methods:

- Gross Margin – The ratio of direct costs to total revenue.

- Operating Profit Margin – The ratio of total operating costs to total revenue during a given quarter or year.

These ratios can help inform your revenue forecasts moving into the future, making key considerations in areas such as customer service and the other costs associated with your business.

Forecast Revenue with Board’s Help

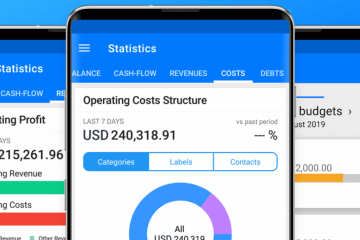

In order to build your business, you need to have data that can inform your decisions and influence your plans accordingly. Board is a solution you can use to gain deeper insight into how your business is operating.

Take the time to learn a bit more about how BOARD works, how it can help with forecasting revenue or start your free trial today.

Try it yourself! Find it on the App Store or Google play or try our WebApp.