How Do Small Businesses Keep Track of Money?

The key to success in business starts with your finances.

So, how do small businesses keep track of their money? In this article, we will dive into the methods, practices, and some common tips that you can use to effectively monitor your money.

After reading, you will have learned:

- How different businesses manage their money.

- The issue of cash and distributed points of sale.

- Tools you can use to stay on top of your business’ finances.

Keeping Track of Money for Different Business Types

The way that small businesses keep track of their money starts by understanding where the “flow” of their money is the most intense.

If we begin by understanding the various sources, we can start to critically connect the dots between the sources and the tracking tools to keep them top of mind.

So, where does money come and go? Typical sources can include:

- Customers – Those who are buying your product.

- Vendors – The people you pay to help deliver your product.

- Employees – Those you trust to execute your vision.

Your goal as a business is to make money. That’s why you need to begin by understanding where cash is coming in, where it is going out, and all the different sources that play roles in either function.

Understanding your cash flow is paramount in all of this, and most successful businesses are able to forecast their cash flow in order to maintain success.

What does this look like? It includes:

- Planning your sales, expenses, funding, or investments

- Forecasting your overall cash flow across every account

- Adjusting to meet your goals by revenues and cost categories

The fact is that the most successful businesses are better able to understand where their cash is originating, where it is going, and what to expect in the future.

Understanding Multiple Points of Sale

How do small businesses keep track of money? The answer is simple: they understand some of the most important things about keeping track of money, your points of sale.

For some, the issue can be as simple as cash and what we call distributed (or multiple) points of sale. This could include the following:

- Who is authorized to handle cash

- How you transport money

- How the end-of-day balance sheet is reconciled

In order to ensure that nothing goes missing, you need to oversee the whole position to avoid:

- Negative balances, and

- Forex risks

There are plenty of other issues that come from not knowing where your money is going (or where it is headed). If you understand your distributed points of sale, you can have a better grip on where your money is headed at all times.

Rely On Tracking Software

We have discussed some of the things you can do to change your thinking in terms of keeping track of your finances, but how do you go about executing it?

One of the biggest things you can do is to trust tracking tools to help make the process easier – while it might feel more nuanced at first, it can quickly become the easiest thing for your business.

The process looks a little something like this:

- Open A Business Account – As opposed to a personal account, keeping your business expenses and finances separate from your personal ones should be your top priority. This allows you to start with a sturdy, clean foundation on which to build.

- Select A Method – There are multiple methods to help track your money (hint: we’ll cover a great one later on), but you need to commit to a method and stick with it. This will allow you to grow a dataset that is truly reflective of your finances.

- Start Tracking – After you have opened your accounts and chosen your method, it’s time to start tracking! Ensure that you have everything connected and in proper order, and then simply watch the results pour in.

Now that you know more about how to track and keep ahead of your finances, you need a platform that you can trust to keep up – not only one where you can record your expenses, but one that can help provide insight that you won’t find anywhere else.

Track Your Finances with Board

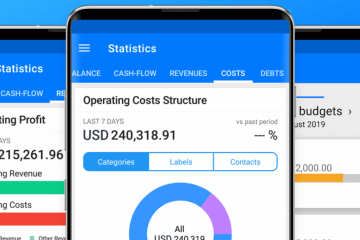

One of the best ways for small businesses to keep track of their money is to employ software that can do it for them. This is where Board comes into the picture.

We built Board as an application for small businesses to manage their growth, profitability, and cash liquidity. All to help them make smarter and timely business decisions.

It’s simple, really, because with Board you can:

- See key performance indicators at a glance

- Perform a deep dive into your finances

- Use templates to create unique dashboards

- Choose from charts and reports to visualize data

Best of all, automated reports help to make better sense of your finances, all while tracking what you are doing and presenting it to you in a handy interface.

If keeping track of your money is at the top of your to-do list, Board can help provide greater insight with less effort and data you can trust.

Want to learn more? Check out some of the benefits of working with Board or how we help small businesses stay on top of their money. Then, sign up today with the WebApp. Or find the app on the App Store or Google play.