How Do Small Businesses Manage Money?

Let’s talk about managing money for small businesses.

This might be one of the biggest challenges that any small business owner can face. You have a great product or service, but you need to know how to sell it, how to grow it, and how to manage your finances along the way.

In this article, we’ll discuss:

- The importance of managing your money

- The first steps you can take

- One key tool you can use to make it easier

Managing Your Small Business Finances: The Basics

If you have a small business, becoming knowledgeable in small business finances is completely necessary. It might not be fun at first, but treating your finances like a chore is typically what causes business owners to fall into unproductive habits.

First, there are the basics – small business finances start with:

- The importance of funding

- Applying for loans/credit cards

- Drafting a budget and working within it

- Making investments to grow your business

While other challenges and considerations may come up, the main things a small business must realize is that managing their money isn’t simply about keeping the lights on.

Instead, it’s about sustainable growing your business in a way that allows you to make money, as well as routine investments into your business.

The First Steps to Managing Your Money

So, what can you do as a small business owner to manage your money from the start?

Let’s break them down for you so you can gain a clearer picture…

Start with a Budget

Managing your money comes from strategic direction. That’s why a budget is so important to the health of any small business. It allows you to take stock of your finances, plan your year ahead, and make monthly or quarterly changes in accordance with performance.

If your business lacks a budget, or an effective way to monitor that budget and its progress, your money will never be managed properly. This is because the direction of your money will lack vision, and will be too focused on the day-to-day when it should be on long-term profitability.

Never Mix Business and Personal

One of the key things that small business owners fail to recognize is that their business and personal accounts should not be treated the same. In terms of your debts, your accounts, and where the money is going in and out, they should always be kept separate.

Understand Cash Flow

Your business simply cannot succeed if you don’t have the cash. That’s why cash flow might be one of the most vital elements of money management for your small business.

In general, your cash flow is the sum total of funds received and spent to keep your business running. It’s about much is flowing in and out to keep your business running.

As critical as a budget, cash flow projections can give real insight not only about where your money is headed, but where it’s coming from and where you might end up falling short.

In terms of managing your money, cash flow can tell you a lot – specifically a cash flow projection, which can chart the development of your cash flow into the future.

Having a proper cash flow projection can help:

- Recognize shortfalls before they happen

- Allow you to plan for problems

- Ensure you have the cash to pay suppliers

Let’s put it like this: if you want to manage your money properly, you need to have a strong understanding of your cash flow. Moreover, you need to know how to put your cash flow data to work for you to help build your business.

Paying Bills

It might sound simple, but one of the biggest problems small business owners have is paying their bills on time. It’s imperative to your business credit that you do this, as one late payment can have a negative effect on your score overall.

Whether credit card fees, loan payments, or paying vendors, not only do the fees start to rack up but it may strain your relationship with the people you need the most. That’s why it is essential to schedule payments, set reminders, and never miss a single one.

Setting Goals

In the same way as budgets and cash flow forecasting help the future of your business, the best small businesses set goals with their finances.

This is one of the keys to managing money as a small business, because goals allow you to drive processes and sales. If you have the opportunity to set meaningful, reasonable goals with your money, it can help you manage it and push things in the right direction.

It can also help you secure funding in the future, so that your business is not only managing money, but growing it at the same time, too.

How To Start Managing Money

It’s true, the more you understand your finances and cash flow, the better prepared your business will be to make important decisions and to grow.

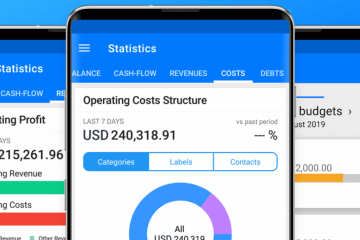

That’s why you need a tool to help get you there, and it’s why we spent the time to craft our application Board, just for you.

It’s a tool that can give you greater insight into your finances, help you formulate budgets, stay on top of payments, and forecast into the future. It’s everything you need to help manage your business’ money, and to make the right decisions with it, too.

After all, the strength of your money is only going to be as good as the tools you manage it with. If you want to give Board a try, start by signing up for our WebApp today. Or, find the app on the App Store or Google Play.