How to Have a Healthy Mix of Credit

Many businesses know that having good credit is imperative to their financial success.

But, learning how to have a healthy mix of credit is more difficult than it seems.

Even if you began your business with your own finances, there will likely come a time that you need them from elsewhere – this is where your business’ credit score plays a huge role.

A strong business credit score can even help:

- Negotiate the best terms with potential suppliers.

- Establish lines of credit with reputable banks/financial institutions.

- Mitigate the risk of applying for loans based on your personal credit alone.

Today, let’s talk a bit more about your business’ credit score, and how you can have a healthy mix of credit to ensure that it stays high.

What is a Business Credit Score?

A business credit score is a number, not unlike a personal credit score, which represents the likelihood your business will be approved for funding (amongst other things).

As opposed to a personal credit score, there are a few key differences when it comes to a business credit score. They are as follows:

- The Range – A business credit score runs between 0 to 100.

- The Ideal Number – Most major lenders require a score of at least 75.

- The Purpose – Lenders rely on these scores to provide lines of credit or extend payment terms.

If you want to limit your personal exposure, establishing a credit score for your business is likely one of the first things you need to do. In fact, separating your business credit from your personal credit is essential for the financial health of your business in the long term.

The thought of building a strong business credit score might keep you up at night, but it’s essential if you want to business to not only survive – but to thrive. It allows you to create positive relationships with lenders, suppliers, and even your clients/customers.

Establishing A Healthy Mix of Credit

One of the key ways to result in a high business credit score is in your mix.

There are a whole host of factors that will contribute to your score, and certain tactics can help each (while others may be more difficult to change). Let’s break down each of them:

- Length – How long you have been in business is going to play a pivotal role in your score.

- Revenues – If your business is bringing in continuous revenue, it can have a positive impact on your score.

- Assets – When your business has assets, such as property, your credit score is going to benefit.

- Debts – The loans and debts that you currently possess, and the frequency with which you pay them, is going to have an effect on your score.

- History – Consider your business credit card – how long have you had it and how quickly do you pay it off, as this can affect your score positively or negatively.

- Industry Risk – Where you work can have an effect on your score – depending on your industry, your score can take a hit.

That said, a lot of these factors may not be something you can change. Thankfully, there are more nuanced ways to add a healthy mix of credit to your operations. They include:

- Factoring – This helps when a company maintains an existing line of credit. One uses future invoices to repay the loan and clear it from their balance sheet. It adds an element of leverage when negotiating with future lenders.

- Trade Finance – These reflect your good record of payments with suppliers and vendors. Some will add them for you, but you can also add them on your own.

- Letters of Credit – This is a letter from a credit that assures a client or customer that payment will be made on time.

- Operating Loans – This is a line of credit that can be used for a business to maintain operations (we’ll profile below how to maintain it for the best credit result).

- Inventory Funding – A means to gain credit from a lender, this is where your available inventory is used as collateral for a lender.

Tactics to Help Maintain Good Credit

Now that you know a bit more about what goes into a healthy mix of credit, it helps to know what you can do to keep it high (or improve it if it has gone too low).

Some of the basics include:

- Using only business cards (and not mixing with personal).

- Making sure all your bills are paid on time (or earlier, whenever possible).

- Taking on debt, when appropriate, to pay back quickly.

- Using only 25% of the credit made available to you by a lender.

Action Steps You Can Take Today

Building business credit takes time, so it’s useful to get a picture of what is your current score and what are areas for improvement. Some credit bureaus provide you reason codes that help explain your score and provide advice on how to improve it.

Track your business credit every quarter. That’s how little it can take for your score to change and can give you a heads up on a damaging report from a vendor or on the effects of an increase in your utilized credit. Take the lessons from every credit score report to learn how to become the type of borrower that a lender caters to in the future.

Check your report for inaccuracies. If you find an error in your report, report it right away to the relevant bureau using supporting documentation. Pay particular attention to errors in information under public records. Bankruptcies, judgments from debt collection lawsuit, and creditor’s legal rights to seize your property in the past seven years on your report could lead to an automatic denial of your loan application.

Gain Insight into your Business with Board

A business credit score helps separate your business from your personal credit and can help grow your business over time with various lenders and institutions.

But, it’s only one part of your overall mix.

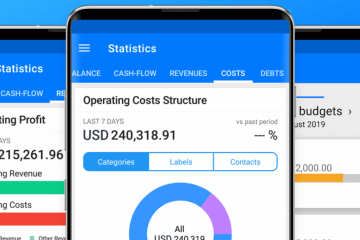

Using Board, you can gain valuable insight into your finances and future projections, which can help power your decision making to grow your business.

Start your free trial today and learn more – try it for yourself. Find it on the App Store or Google play or try our WebApp.