How To Prepare Your Business’ Annual Budget

The key to your business’ success is a proper budget.

Why is that? Well, a budget helps to prioritize your finances and to help build the annual goals, objectives, and deliverables that will help your business grow. In all, learning how to prepare your business’ annual budget is a great place to start.

After all, when you commit numbers to paper, your business builds a potential track record of success and guidance to help lead you forward. You can better anticipate your needs, mitigate risks, and spot any issues with cash flow.

In this article, we will cover:

- Setting budgeting goals

- Building a plan that works with your budget

- The ideal way to set up a budget

Preparing Your Budget: Goals

Whether your company is in its first, second, or fifteenth year, you need to have goals which dictate the way your budget will look (and what it will include).

If you sit down to put together a proper business budget, you gain valuable insight into how your business has been performing – and how it should perform in the future.

At the same time, you may be able to foresee cuts which could improve your bottom line, or identify free cash to help re-invest in your operations.

That is why goals are so important – they set the tone for your budget and what you plan on covering. Are you focused on growth? Maintaining the bottom line? Or working through issues with cash flow?

No matter what you end up deciding, you should come into discussions surrounding your annual budget by determining what you want to cover in the year ahead.

Building A Plan for your Budget

After working through your goals, you need to have a plan.

This includes a plan that involves both revenues and costs. You need to balance these equally, understanding where the money will be coming in and where it will be going out.

In general, your budget should be used to identify:

- Funds required for labor and materials

- Start-up costs for new businesses

- How much it costs to operate

- The revenue you need to grow

- An estimate of expected profits

Specifically with an annual budget, you can update it with investments and revenue each month of the year, so that you know where your money is going and whether it lines up with your goals from the beginning of the year.

If you end up missing your targets, you can start to strategize and game plan a way to use your budget to identify and figure out what may need to change.

Different Ways to Set an Annual Budget:

If you are thinking of preparing your business’ annual budget, there are two ways to do it:

- Bottom-Up

- Top-Down

Let’s cover each in greater detail…

The Bottom-Up Method

If you are approaching your annual budget with a bottom-up approach, you need to start with fixed costs, followed by variable costs, and reconcile each with your revenue.

At the same time, check the breakeven point – if it’s not in line with your expectations for your business, then you need to re-engage with the budget to make it that way.

The Top-Down Method

This is another way to go about preparing your annual budget. Going from the top down, you may start with your revenue forecasts – followed by your variable and fixed costs.

All of this is designed to meet your profitability expectations. Finally, though, you should check feasibility and, if needed, adjust the budget as required.

Overall Takeaways

Basically, your budget should include:

- Your Revenues

- Your Costs

- Your Profits

When you include all three, you can properly figure out if you have the funds left over for improvements to your business.

No matter how you go about doing it, an annual budget for your business can help add clarity and focus to your monthly performance.

Annual Budget Considerations

Every year, your expectations and goals for your budget may change. It may change based on:

- Shareholders

- Investors

- Taxes

- And more…

The important thing to remember is that your budget is also a form of stakeholder management. It helps to outline the plan for your business, and it needs to appease the appropriate audiences that are interested in your business’ plan.

As you go from year to year, it is important to keep all of this in mind. Your budget should be changing with the goals of your business, so at the beginning of the year it helps to set your goals and to chart a course to help you get there.

All these things considered, speaking annual, a budget can help:

- Make your business more efficient month-over-month

- Pointing our leftover funds to be reinvested

- Predicting slow months to keep you out of debt

- Profit estimations and a glance into the future

- Helping maintain control over your business.

Your budget may change, but the success of your business is going to rely on your ability to line up your annual budget with the expectations of your audience and your overall goals.

Start Budgeting with Board

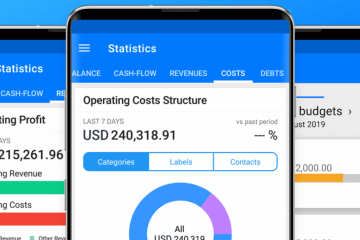

Board is a tool which helps you stay on top of your business’ finances.

At a glance, you can see your key performance indicators, dive into your financial results, while customizing the experience to suit your goals (and the data you need to see).

When it comes to budgeting for the year, all this insight can be invaluable to your process. You get the opportunity to:

- Save time with automated reports

- Base budgeting decisions on numbers

- Create views specific to your needs

By keeping all of your costs and revenue in one place, you also gain access to value cash flow trends and forecasting to help you grow your business.

Board even has a budgeting feature! You have the chance to budget your expenses, make informed decisions, and keep up with your results in real time.

Interested in learning more? You can find out more by clicking this link or jumping right in and starting to use Board for yourself – and your business – today.

Find the app on the App Store or Google play.