Why is a Cashflow Projection Important to Your Business?

While you can’t see into the future, you can get quite close with the right data.

In fact, cash flow projections might be the closest you can get to predicting the future of your business without looking into a crystal ball.

These types of models are one of the best ways to make timely decisions on how to use free cash or resolve difficult situations before they even occur.

Let’s discuss a bit about the importance of cash flow projections and how using them can help improve the future of your business.

What Is Cashflow?

Your business cannot succeed if you lack cash. In fact, cash flow might just be one of the most vital elements of any business.

Think of it like this: your cash flow is the sum total of money received and money spent to keep your business running.

If we break it down even further, though, we can consider it in terms of:

- Money Received – The sum total of operating revenue (selling goods and services) as well as new funding (equity investments, etc.).

- Money Spent – These include your operating costs (like space, payroll, and more) as well as repayments and acquisitions.

Without a positive cash flow, your business cannot survive. Therefore, understanding how much is coming in, going out, and when is key.

The important thing to note is that cash flow isn’t always consistent. Cash flow projections help to plan for those inconsistencies to make more relevant business decisions.

It doesn’t matter how hard you work, or the product you have on hand, there will come a point where you may fall short. When this happens, it’s better to expect it and to know it’s likely to happen – this is one of the main benefits of embracing cash flow projections.

Why Cashflow Projections Are Essential

A cash flow projection is a prediction of what you to expect to happen, with regards to your cash flow, in the coming months.

It stems from being able to keep a close eye on your finances. From that point on, you can begin to make calculated estimates about the future of your business (and plan from there).

As critical as a budget, cash flow projections can give real insight not only about where your money is headed, but where it’s coming from and where you might end up falling short.

In terms of solving problems before they arise, a cash flow projection can:

- Identify potential shortfalls in cash balances

- Enable you to identify when problems may occur

- Ensure you have enough cash to pay suppliers/employees

Most business owners use cash flow projections as a warning system to help them identify when things may be tight (and when changes might be in order). If you are going through a period lacking in cash, a cash flow projection can help develop options beforehand.

It is also a great opportunity to determine when free cash can play a role in growing your business. If a cash flow projection can tell you when you’re tight on money, it can also tell you when extra money is coming in – allowing you to make additional hires and investments to keep your business healthy.

Decisions Cash Flow Projections Impact

Issues stemming from cash flow are easier to identify with proper projections, and here are just some of the decisions you may need to make:

- Cutting Costs – Whether the costs of your overall business or the expenses you are paying, a cash flow projection can help you take a critical look through all your money going out (in hopes of cutting dead weight when necessary).

- Charging & Billing – A cash flow projection can help understand if your prices are keeping up with the growth of your business. You may be afraid to charge more for your services, but running out of money may be the motivation you need to charge what your time is really worth.

- Prioritizing Customers – Understanding your cash flow can help pinpoint ways in which to keep customers around for longer (and to turn them into brand advocates). Small changes can help improve cash flow by prioritizing experience.

- Maximizing ROI – Your cash flow can reveal the most efficient ways in which your business makes money. By considering which products and services offer the highest ROI, you can prioritize those to build your business.

- Invoicing Improvements – Invoicing is key to the money coming into your business, and a lack thereof can reveal significant problems. Whether in quantity, timing, or whatever else, a cash flow projection can reveal where your invoice is failing to live up to the task.

- Borrowing Funds – It’s always better to have access to funds before you really need them. With a sturdy cash flow project into the future, you can identify when you may need to take our a loan to help sustain your business during down cycles.

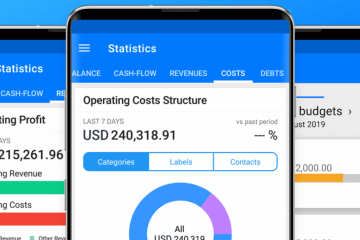

Understand Your Cash Flow with Board

Critical decisions can be made with more security when you have cash flow projections on hand. This all starts with a more in-depth understanding of your finances, where your money is coming in, and where it’s going out (and when).

In business, timing is everything, and you need to be sure that you have a great sense of timing to help safeguard the future of your business. Board can help. Click here to learn more or start your free trial today.

Find it on the App Store or Google play or try our WebApp.