Why Is Revenue Forecasting Important?

One of the most important things for your business is direction.

This comes from not only understanding where you have found success, but where you continue to drive business and what you can to plan for a secure financial future (accounting for both missteps and leaps in growth).

Why is revenue forecasting important? Because it shines a light on the state of your business in the past (and moving forward). It helps you plan effectively, make strong decisions, and take your business to new heights – without feeling in the dark.

The best part is that forecasting is driven by concrete information and actionable insights.This takes your financial future from wishlist to business plan.

What is Revenue Forecasting?

Let’s begin with a precise understanding of what constitutes revenue.

Essentially, revenue is the money you receive from doing business (like selling goods or providing services, etc.).

It’s most important to differentiate between revenue and sales. While sales is the amount of contracts signed and money eventually coming in, revenue is real dollars that you are bringing home every period (whether in the week or the month).

When it comes to revenue forecasting, too many entrepreneurs consider sales to be the same as revenue – but that is far from the truth.

The best way to forecast is to focus on the specific amount of money you are bringing home in a defined period, not promissory funds to be honoured later on.

Ultimately, revenue forecasting is an in-depth analysis of past performance to help understand how much your business might bring in during the upcoming year.

The Principles of Revenue Forecasting

Revenue forecasting is an important part of any business plan, because it can help strategize how much and how quickly you intend on growing your company.

That said, it is also the most difficult to estimate. This is counter to things like costs and funding, which are far more under your own control.

Let’s think of revenue forecasting in terms of three principles:

- Analysis

- Management

- Strategy

First, you have analysis. This is the first thing that forecasting requires – a deep dive into your numbers, where you’ve been, and what you might need moving forward. You need to make sense of where your money is going, and where it could be headed.

Next is management. Revenue forecasting always loops back to the day-to-day structures that are in place to manage the money going in and out of your business. Therefore, it’s not just about where your money might go – but where it is currently heading.

Lastly, we have strategy. When it comes to discussing revenue forecasting, it all comes back to growth. Understanding where you might be making your money helps inform decisions around your business. This could include marketing, product offerings, or who you have on staff.

It’s a holistic mix, and it is absolutely essential to the livelihood of your business.

How Often Should You Forecast?

Another question that often comes up is the frequency with which you should forecast revenue.

Establishing meaningful timelines can help power decisions in your business, and can play a vital role in understanding if you are growing at all.

Typically, your first revenue forecast should occur as part of your overall business plan. The best way to start is by forecasting out 3 – 5 years, with updates each and every year.

Following that, you maintain what is known as a “rolling revenue plan” – this forecasts for the next four quarters, and is updated on a monthly basis.

Last, but not least, you keep track of your monthly revenue forecast versus what you actually brought in (this can be done daily or weekly).

It may seem like a great deal of forecasting, but it is essential that you maintain continuous knowledge of whether your forecasts are hitting their targets.

Once you know how to do it, here’s how it can impact your business decision-making…

How Revenue Forecasting Benefits Your Business

By now, you have a pretty good idea of what forecasting entails – but how do you turn all of that valuable data into actual business making decisions? It’s even easier than you think.

There are different methods that you can use to utilize revenue forecasting (you can learn more about them by clicking this link. Until then, let’s break down just how important it is to your business.

What is revenue forecasting? It’s a solution built to improve…

Marketing Your Business

Let’s consider marketing to two key segments: investors/institutions and your consumers. Both of these are not only important but essential for the long-term sustainability of your business.

Realistic revenue forecasting can help your business take objective data and turn it into a convincing argument for both investors and potential customers. It can help secure a partner, investor, or simply obtain more money from a financial institution.

At the same time, it can help you better understand your client base and what moves them to make a purchase. When you know this, you can build a proper nurturing cycle and pipeline to reach them at key times of the year (which benefit your business).

Think about it like this: if you forecast revenue for a restaurant, you can understand when the most customers come (and when the least come). During busy season, you can advertise dishes which make you more money – when it’s not, you can come up with ideas to sell products simply to get people in the door.

Hiring & Investing

What if you need more expertise on staff to take your business to the next level? Revenue forecasting can help you make long-term investments in your workforce (without necessarily worrying about having to feel the pinch on your purse strings).

If you consider how your current employees are working, forecasting can give you a better sense of replicable performances that can provide more revenue down the road (even if it comes at a cost in the beginning).

One of the key ways to help your business grow is to invest back into it. Once you have a better idea, though, of where your money is going currently, you can make decisions about where to route it (or where you can bolster it to grow even more).

Futureproofing Declines

Some look at revenue forecasting as a silver bullet – meaning that it will only show you the success of your business moving forward. While it is important to account for growth, forecasting can also help you game plan for declines.

A deep dive into your data can help understand when things will slow down. Conversely, it can give you a sense of things heating up in your market (such is the case with emerging technologies and accelerating customer acquisition).

Understanding when things are working, and when things are slowing, can help with strategic investments in how you hire, when you market your business, and when you reach out to investors.

This sense of futureproofing your business is an essential element of revenue forecasting.

Cash Flow Management

Managing your business is typically top-of-mind for business owners. As an owner, you need to avoid missing any payments, accruing late fees, and maintaining good credit to help fortify your business in the future.

With revenue forecasting, you can keep track of when cash will come in and when it will be in lesser quantities. This can help you properly schedule your cash flow to benefit how you work (and how you grow).

This also helps during tax season, when you need to really know how much you owe and how much you need to have on hand.

Expansion & Competition

Think about an industry like consulting, marketing, or any other professional service.

When you forecast using both existing and returning customers, you can understand how your busy is growing relative to the competition.

This takes into account potential geographic expansions, the types of services you offer, and the margins of those services to help draw in new customers (and keep your existing ones).

If you know more about the typical size of the deals that you provide, you can begin to understand if they can be bolstered, and even if they are serving your target market – from there, you can begin to think of how your competitors are doing it differently and how you may be able to expand into other realms.

Get On BOARD with Real Insight

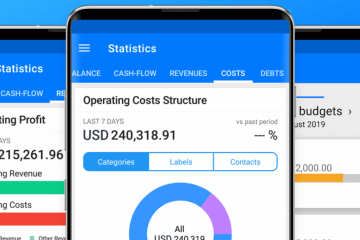

BOARD is a tool designed with business owners in mind.

We can help with cash flow forecasting, as well as gaining greater insight into how your business works and how it can work in your favor.

Taking raw numbers, translating them into action, start your free trial today. To learn more try it for yourself.

Find it on the App Store or Google play or try our WebApp.