Accelerated Earnings: How To Get Positive Cash Flow Fast

For your business to succeed, you need cash flow.

Whether to pay employees, to purchase inventory, and to deliver services while covering your operating costs. So, when you need it most, do you know how to get positive cash flow fast? Let’s talk about it.

This article will cover:

- The importance of cash flow to your business.

- How you can get cash flow moving faster.

- The best ways to track and analyze cash flow.

The Importance of Cash Flow

Lacking cash is a huge problem for your business, which is why cash flow is so important. Think of it in terms of money spent and money received, and how combined they help keep your business running smoothly.

Maintaining positive cash flow, though, will not open on its own. In order to maintain it, you need to plan ahead, to take proactive action, while keeping a close eye on your financials in both the present and the future.

Cash flow is rarely consistent. While you can have a fairly good handle on it with cash flow projections, you still need to plan for inconsistencies and periods in time when your business will need more money than it has on hand.

When you do fall short, though, you may need to consider some strategies to boost your cash flow quickly – here’s what you can consider…

Getting Positive Cash Flow, Fast!

Even if your business’ future is stable and sturdy, short-term issues in terms of bills and investments may impede your ability to succeed. Instead, there are things you can do to “cash in” using short-term strategies for long-term benefit.

There are four unique ways to keep cash flowing into your business when you need it most:

1. Discount Strategically

While offering your products and services may seem like a good idea to get customers in the door, you need to do so very strategically (or else you’re running at a loss with no hope of future profitability).

Discounting may seem like a sound strategy, but you need to know the costs and the impact it is going to have on your services moving forward. This includes knowing:

- How much you should ideally charge

- The total cost of the offer you’re making

- The profit margins on products or services

Your discount may be popular, but is it profitable? If you want to get positive cash flow fast, you need to make sure that any discounts you’re offering line up with the reality of your balance sheet.

It may also be wise to consider a discount for prompt payment. This way, you can incentive the behaviour that will get your cash flow much faster.

2. Bundling Works Better

Where discounting is risky, bundling is a more sound strategy for cash flow success. This is a form of adding value, but “bundling” products of services together to attract interest and repeat business down the road.

Whether it’s an additional deliverable, a maintenance package, or some form of consulting service or add-on – you can increase your initial price point, boosting your cash flow, while lowering the perceived risk your product may carry.

Put together, a bundle may increase your cash flow while decreasing the time required to make it work. Consider the ways you can quickly and easily alleviate issues clients may have with your product or service – and bundle it in one package.

3. Encourage Repeat Clients

Quickly gaining cash flow is typically dependant on encouraging people to buy more and more of what you’re selling – therefore, you need to incentivize repeat business to keep people coming through your door.

This could include things like:

- Loyalty Programs

- VIP Offers

- Frequent-Shopper Offers

By creating any of these, you begin to not only familiarize people with your offerings, but build brand equity between what you do and what they need.

In order to get positive cash flow fast, though, you need to ensure that people are coming back in a short time frame. This could also include a back-end product or service, where you offer a part of your service for free and build upon it with other necessary asks or support.

4. Pre-Selling for Fast Cash Flow

If you need to get positive cash flow fast, one of the easiest things you can do is to pre-sell your services to people who are planning for the future.

This is a great way to get people excited about your services while having them sign up to receive them prior to them being executed.

Another way to do this would be to plan for a deposit in order to begin projects. This way, you get a quick injection of cash before you start working – increasing your cash flow without impeding your business.

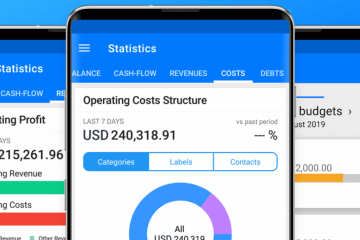

Track Your Cash Flow with Board

The first step to managing your cash flow is ensuring that you have the right tools to keep track of it in the first place. This is where Board comes in to help.

Board has been developed as the solution small business owners need to manage their finances, and to keep track of their cash flow (and cash flow projections) for future success.

Having money left over at the end of the month allows your business to succeed, to grow, and to continue doing what works for you – which is why Board has been developed with you in mind, attuned to your goals and your future success.

Learn more about the benefits of using Board today and then sign up to start using the Web App right away. From there, and using the strategies we shared together, you can keep a close eye on your cash flow for future success.