Master Cash Flow Management with Board

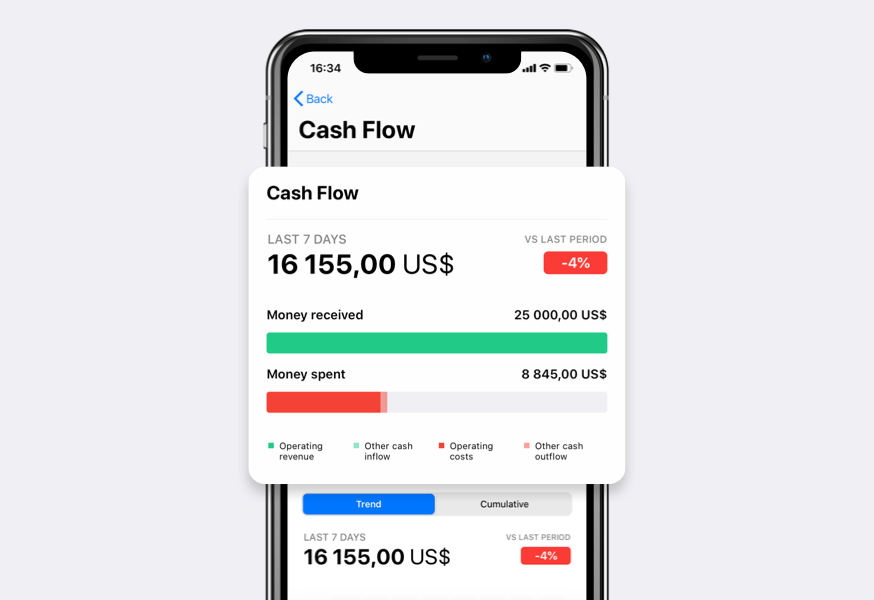

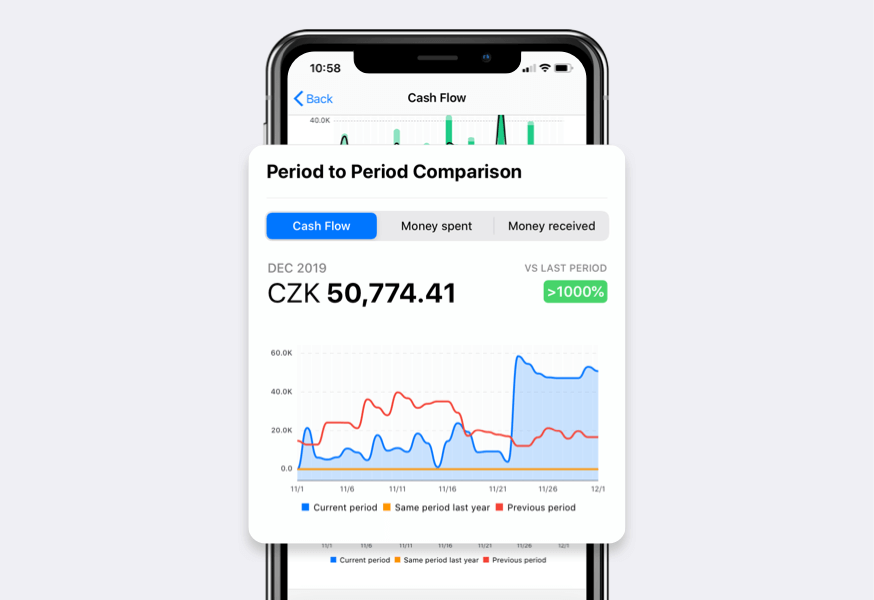

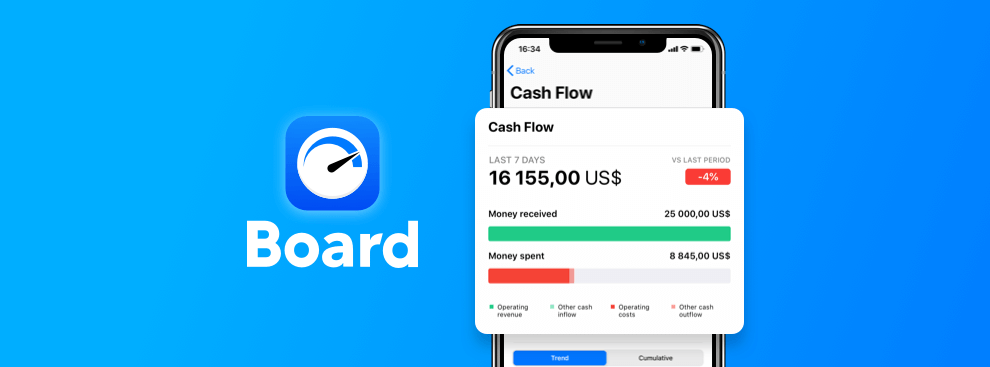

If you’re using Board to analyze your business’s finances, one of the key metrics you’ll see identified right at the top of the dashboard is cash flow. You may at first notice this metric, and not realize how vital it is.

In this post we’re going to talk about why cash flow is such an important metric for the health of your business, and how you can use Board to measure and improve your cash flow situation.

What Exactly is Cash Flow?

In the simplest terms, cash flow is the result of all the payments coming into the business, minus all the payments going out. Cash flow is distinct from “profit” or “income,” in that it is an expression of the exact cash situation of the business at any given time. When a business is taking in more cash than is going out, we refer to this as “cash flow positive.” When cash is leaving the business, it is said to be “cash flow negative.”

Money in Vs. Money Out

The most important thing to consider about your cash flow is that your “money in” has to equal your ”money out.”

For many small businesses, especially businesses with irregular incomes, structuring cash flow is essential to survival. While you may have contracts signed and orders pending, these are not money in the bank. On the other hand, in order to fulfill orders and to make sales, often you must spend money. Balancing this equation is where Board becomes valuable.

Simple Cash Flow Planning

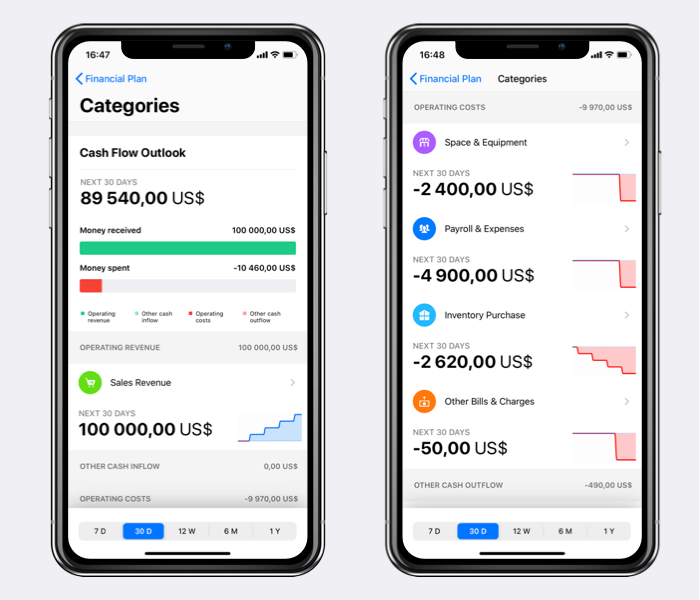

The first step to maintaining a healthy cash flow is to make sure that your future outgoing payments will be fully covered by scheduled incoming payments.

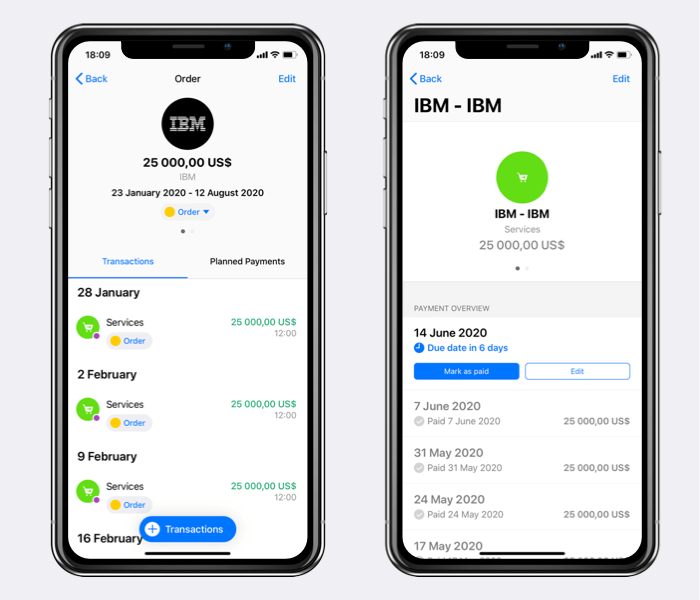

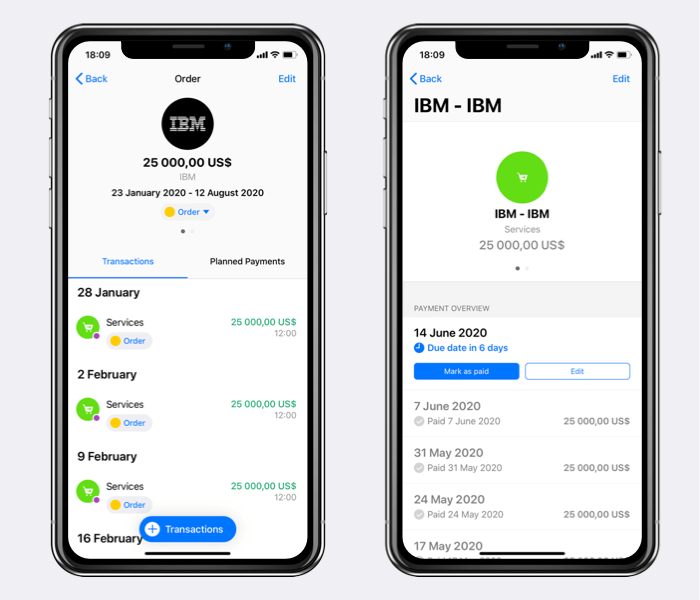

With Board, you can first set up all your recurring expenses to appear in planned payments. If your business has mostly fixed costs and fixed incomes, then generating a future balance projection is pretty simple.

On the other side, every time you take an order or send an invoice, that can also be added to your future payments as an income.

Profit and Loss Projections

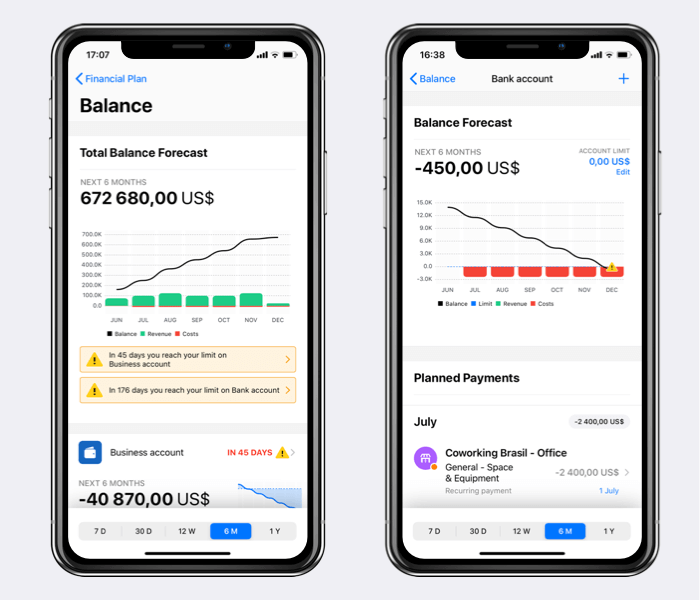

Sometimes businesses plan to be cash flow negative over some period of time, such as early in their operations, or while investing in new technology or equipment. In cases like this, it’s still important to keep note of your expected future cash balances, so that they never drop below safe levels.

Your cash balance projection can be used to find your “business runway,” which means the amount of time you have with your current cash flow before you run out of money.

Your runway is equal to your total available cash, divided by your negative monthly cash flow, expressed in months. So for example if you have $5000 in the bank, and your negative cash flow is $1000, then you have a runway of just 5 months. This will show in Board as your future balance reaching zero on a specific date.

If you are getting close to “break even,” this means that your cash flow is approaching zero, and your runway is increasing to infinite. If I have $5000 in the bank but I am only losing $100 a month in cash flow, then I have 50 months, or over 4 years, to grow my business before running out of cash.

Alternatively, I could make small adjustments to my cost side in order to become profitable over that time.

Order to Cash Cycle

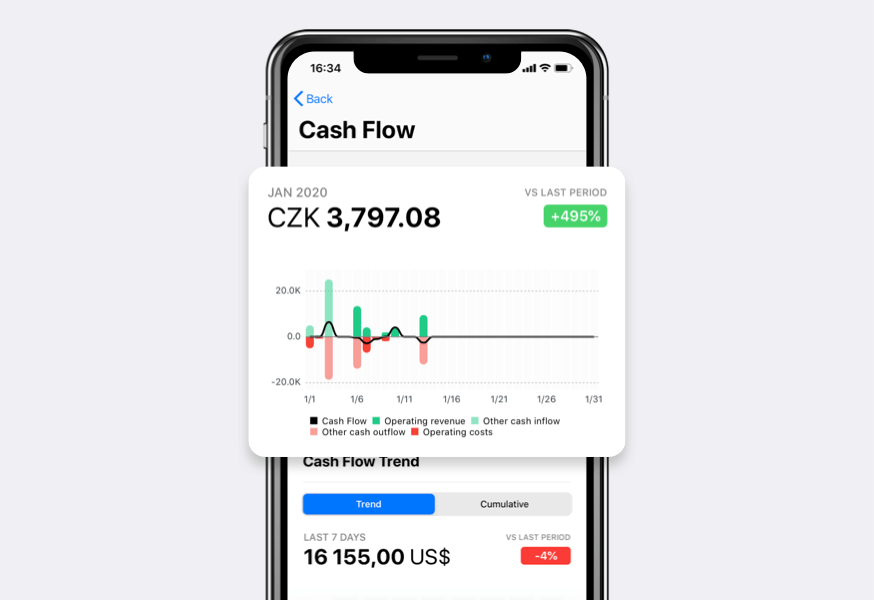

Many businesses don’t have a simple cash flow picture, with nothing but fixed costs and fixed incomes. Usually, income and costs are variable, either by the season, or even by the individual customer or order.

Understanding your Order to Cash Cycle means understanding the process by which you take an order or sign a contract, do the work, deliver the work, and get paid. It may also mean how long it takes between your order and paying for a product, and then selling it to your customer, if you are a retailer.

In some cases, retailers may even have a negative order to cash cycle, meaning that they can sell products for a profit before paying their suppliers. If you understand this cycle, then you can take advantage of it by ordering goods before you are able to fully pay for them.

Understanding your Order to Cash Cycle

How long does it take from the day your client makes an order, to the day there is cash in your bank account for that order, and what happens in between to your cash flow?

Depending on the business, this can be a simple cycle, or a complex one. If your business is selling paper, then it may be as simple as taking the order, setting a delivery date, sending an invoice, and getting the invoice paid.

If you’re in a business with a more complex cash flow, then you may need to include many more steps. A carpenter, for example, will have to consider the cost of hiring laborers, the cost of materials, and the cost of transportation and any other expenses in a job long before they get paid. They must also consider how long it may take from the completion of the job, to the acceptance of the job, to the receipt of payment. What if the customer isn’t satisfied or needs revisions?

Using this Data to Improve Your Business Strategy

Thus your balance projections may indicate that you need to ask for some amount of money up front, if you can’t afford to cover all of your costs before being paid. You may need to change your business terms.

It may also be possible that you are taking too many orders at once, and won’t be able to finance all of them before being paid. Then you should reduce your sales efforts and focus on existing customers. The opposite might also be true; you may find that you have excess cash, and should be looking for more customers to utilize your resources.

By entering all of these details into Board under planned payments, you’ll be able to see how your expected cash flow affects your future cash balance. You will see that just because you have orders signed, doesn’t mean you will be able to service all of your customers. If at any time your balance is set to go below zero, then something has to be adjusted. Either you need to get paid sooner, or you need to reduce your costs.

Using Cash Flow as a Guide

With a picture of how your cash flow works, you can make smarter business decisions. Decisions driven by cash flow, instead of just by instinct, help a business remain healthy.

Chasing large sales, rather than booking more, smaller sales, is a common way for small businesses to run out of money. This happens when entrepreneurs forget the basics of cash flow, and focus on the wrong things, like the size of a contract, rather than its profitability or cash flow impact.

Paradoxically, many small businesses fail, even as their income increases over time. This is because they don’t understand their cash flow, and as a result, make the wrong decisions about what to sell, and at what prices.

Understand Your Cash Flow with Board

Board is built around helping you understand your cash flow situation.

Log in to Board today to assess your small business cash flow, and see if your business is really performing the way it should be.